Ssi Benefits For Children With Down Syndrome

Ssi benefits for children with down syndrome. Parents applying on behalf of a child with Down syndrome will have income limitations as well. If your child has non-mosaic Down syndrome or Trisomy 21 he is automatically eligible for disability benefits. In many cases children who are diagnosed with Down syndrome automatically qualify for SSI benefits.

1006 Non-mosaic Down syndrome. For example an adult with Down syndrome cannot have more than 2000 in saved income and cannot earn more than 750 per month in 2018. In the case of the more rare mosaic Down syndrome the Social Security Administration SSA will require the results of additional analysis and tests and also evidence to prove that the child is disabled enough to require benefits.

Mosaic Down Syndrome doesnt have a specific SSA listing for children or adults. To be eligible for SSI benefits a child must be either blind or disabled. If you care for a child or teenager with a disability and have limited income and savings or.

These benefits are only available for the most financially needy applicants. Just being diagnosed with mosaic Down Syndrome doesnt meet the requirements for benefits approval. The Social Security Administrations Blue Book confirms that children diagnosed with Trisomy 21 or Translocation Down Syndrome automatically medically.

An applicant with Down syndrome will qualify for disability benefits if he or. SSI is awarded based on financial need. The SSA considers Down syndrome to be one of the Impairments that Affect Multiple Body Systems under Section 11000.

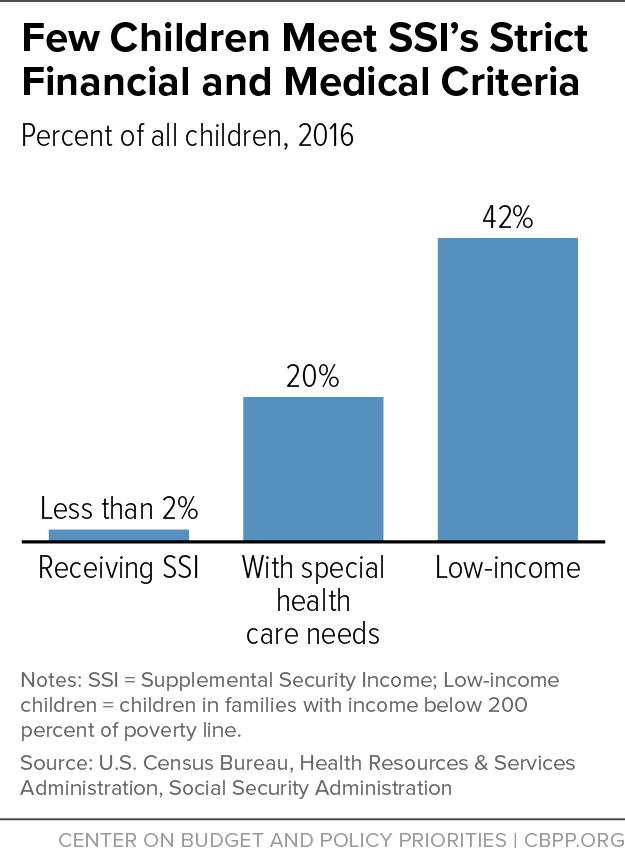

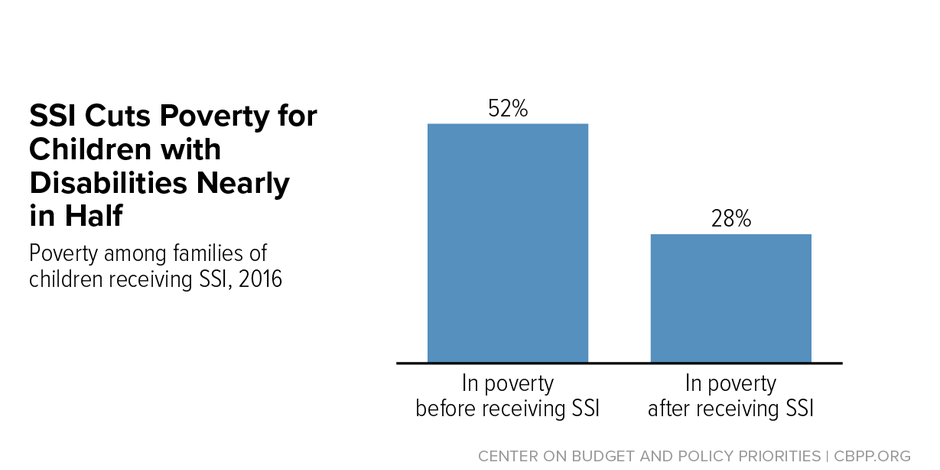

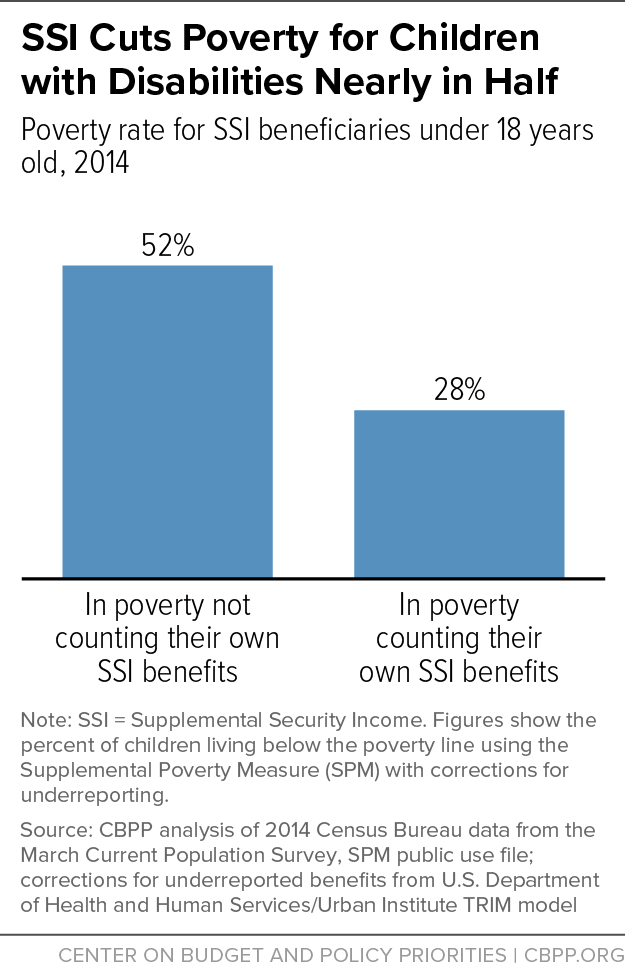

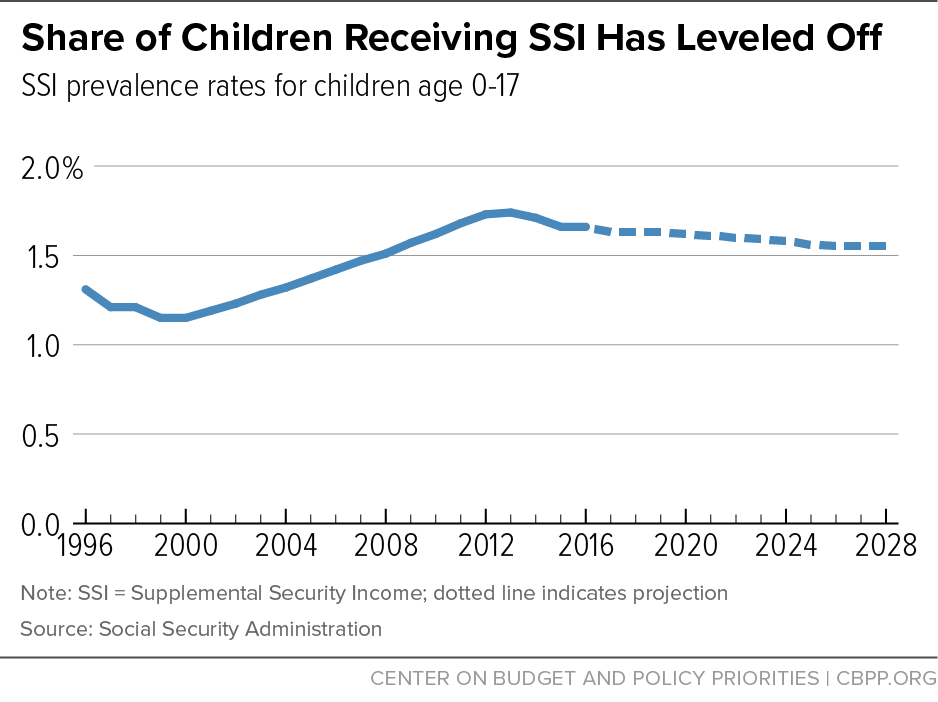

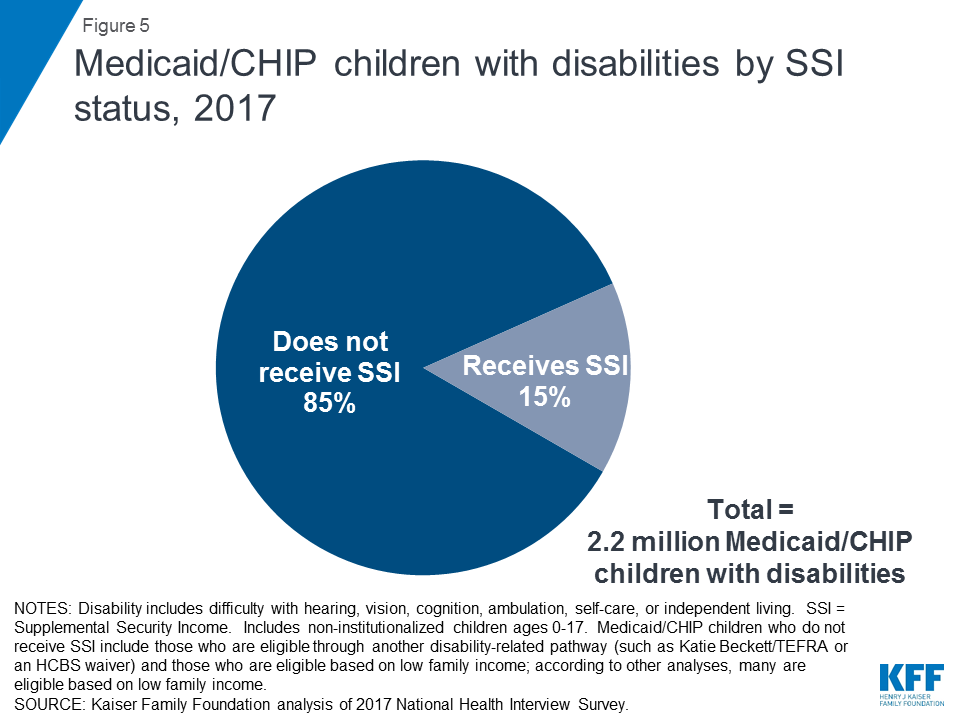

Down syndrome is covered under the Social Security Administration SSAs Blue Book of impairments under Section 11000. Supplemental Security Income SSI is the only source of federal income support targeted to families caring for children with disabilities and it reaches only the lowest-income and most severely impaired children. The SSA differentiates between Non-Mosaic Down Syndrome and Mosaic Down Syndrome and considers people with non-mosaic Down syndrome as being disabled from birth and automatically eligible for Social Security disability benefits.

For example an applicant with mosaic down syndrome who has hearing problems would be evaluated under Chapter 2 Special Senses and Speech. These children live with conditions such as Down Syndrome cerebral palsy autism intellectual disability and blindness.

Parents applying on behalf of a child with Down syndrome will have income limitations as well.

An individual is limited to 733 in monthly income and 2000 in assets and a couple is limited to 1100 monthly income and 3000 in assets. Just being diagnosed with mosaic Down Syndrome doesnt meet the requirements for benefits approval. The short answer is It depends And it depends on many factors most notably the type of Down syndrome diagnosed. Legal Information Books from Nolo. An applicant with Down syndrome will qualify for disability benefits if he or. If you care for a child or teenager with a disability and have limited income and savings or. Supplemental Security Income SSI is the only source of federal income support targeted to families caring for children with disabilities and it reaches only the lowest-income and most severely impaired children. A child cannot receive SSDI benefits based on their own earnings a person isnt able to work the required length of time before that person turns 18. In many cases children who are diagnosed with Down syndrome automatically qualify for SSI benefits.

If your child or family member has Down syndrome he or she may be eligible for financial assistance to help pay for any medical care housing costs caretakers and any other daily living needs. Often a parent will simply need to submit the diagnosis and the childs medical records to the SSA as proof and the child will medically qualify benefits. If you have been diagnosed with non-mosaic Down syndrome then you will not be assessed for the type of work you can perform as Non-Mosaic Down syndrome automatically qualifies for disability benefits. An individual is limited to 733 in monthly income and 2000 in assets and a couple is limited to 1100 monthly income and 3000 in assets. Does Social Security consider Down syndrome to be disabling. In the case of the more rare mosaic Down syndrome the Social Security Administration SSA will require the results of additional analysis and tests and also evidence to prove that the child is disabled enough to require benefits. For example an applicant with mosaic down syndrome who has hearing problems would be evaluated under Chapter 2 Special Senses and Speech.

Post a Comment for "Ssi Benefits For Children With Down Syndrome"